Published: November 16th, 2021

The www.skechers.co.uk/ website (the “Site”) is a service of Skechers USA, Ltd., a wholly owned subsidiary of Skechers U.S.A., Inc. (“Skechers”). These Terms of Use, along with any other terms and conditions that may appear on the Site from time to time (collectively, “Terms”), set forth the terms and conditions under which you may access and use the Site.

BY ACCESSING THE SITE, YOU AGREE TO THESE TERMS. IF YOU DO NOT AGREE TO THESE TERMS (WITHOUT MODIFICATION), YOU ARE NOT AUTHORIZED TO ACCESS OR OTHERWISE USE THE SITE.

You represent and warrant that you are 16 years of age or older, or are visiting the Site under the supervision of a parent or guardian.

If you have any questions regarding the Site, these Terms or have any other customer service needs, please contact us at:

Skechers USA, Ltd.

CT3 Centrium, Griffiths Way, St Albans,

Hertfordshire, AL1 2RD

+44 1707 655955 (Mon-Fri 9:00am to 5:00pm, GMT)

ukinfo@eu.skechers.com

Copyright

The entire content included in the Site, including but not limited to text, graphics or code is copyrighted as a collective work under the United States and other copyright laws, and is the property of Skechers. The collective work includes works that are licensed to Skechers USA, Inc. II Copyright 2018, ALL RIGHTS RESERVED. Permission is granted to electronically copy and/or print hard copy portions of the Site for the sole purpose of placing an order with the Site. You may display and, subject to any expressly stated restrictions or limitations relating to specific material, download or print portions of the material from the different areas of the Site solely for your own non-commercial use, or to place an order with the Site or to purchase Skechers products. Any other use, including but not limited to the reproduction, distribution, display or transmission of the content of the Site is strictly prohibited. You further agree not to change or delete any materials downloaded or printed from the Site and you must not use any illustrations, photographs, video or audio sequences or any graphics separately from any accompanying text. Skechers’ status (and that of any identified contributors) as the authors of content on the Site must always be acknowledged. If you print off, copy or download any part of the Site in breach of these terms of use, your right to use the Site will cease immediately and you must destroy any copies of the materials you have made. No right, title, or interest in or to the Site or any content on the Site is transferred to you, and all rights not expressly granted are reserved by Skechers.

Trademarks/Intellectual Property

All trademarks, service marks and trade names of Skechers used in the Site (including but not limited to the Skechers name) are trademarks or registered trademarks licensed exclusively by Skechers SARL. They may not be used without Skechers’ prior written permission. Any other intellectual property on the Site, including but not limited to patents, issued or pending, are the sole property of Skechers SARL and/or its licensors.

Links

Where the Site contains links to other sites and resources provided by third parties, these links are provided for your information only. Such links should not be interpreted as approval by Skechers of those linked websites or information you may obtain from them. Skechers has no control over the contents of those sites or resources.

Warranty Disclaimer

Please note that Skechers only provides the Site for domestic and private use. You agree not to use the Site for any commercial or business purposes, and Skechers has no liability to you for any loss of profit, loss of business, business interruption, or loss of business opportunity.

We will not be liable if for any reason all or any part of the Site is unavailable at any time or for any period. From time to time, we may restrict access to some parts of the Site, or the entire Site, to users, including registered users.

Skechers does not exclude or limit liability to you where it would be unlawful to do so.

Viruses, Malware, and Account Security

Skechers does not guarantee that the Site is secure or free from viruses or malware. You are responsible for configuring your information technology to access the Site. You should use your own virus protection and malware protection software. TO THE FULLEST EXTENT PROVIDED BY LAW, WE WILL NOT BE LIABLE FOR ANY LOSS OR DAMAGE CAUSED BY A DISTRIBUTED DENIAL-OF-SERVICE ATTACK, VIRUSES, OR OTHER TECHNOLOGICALLY HARMFUL MATERIAL THAT MAY INFECT YOUR COMPUTER EQUIPMENT, COMPUTER PROGRAMS, DATA, OR OTHER PROPRIETARY MATERIAL DUE TO YOUR USE OF THE SITE OR ANY SERVICES OR ITEMS OBTAINED THROUGH THE SITE OR TO YOUR DOWNLOADING OF ANY MATERIAL POSTED ON IT, OR ON ANY SITE LINKED TO IT.

YOUR USE OF THE SITE, ITS CONTENT, AND ANY SERVICES OR ITEMS OBTAINED THROUGH THE SITE IS AT YOUR OWN RISK. THE SITE, ITS CONTENT, AND ANY SERVICES OR ITEMS OBTAINED THROUGH THE SITE ARE PROVIDED ON AN "AS IS" AND "AS AVAILABLE" BASIS, WITHOUT ANY WARRANTIES OF ANY KIND, EITHER EXPRESS OR IMPLIED. NEITHER THE COMPANY NOR ANY PERSON ASSOCIATED WITH THE COMPANY MAKES ANY WARRANTY OR REPRESENTATION WITH RESPECT TO THE COMPLETENESS, SECURITY, RELIABILITY, QUALITY, ACCURACY, OR AVAILABILITY OF THE SITE. WITHOUT LIMITING THE FOREGOING, NEITHER THE COMPANY NOR ANYONE ASSOCIATED WITH THE COMPANY REPRESENTS OR WARRANTS THAT THE SITE, ITS CONTENT, OR ANY SERVICES OR ITEMS OBTAINED THROUGH THE SITE WILL BE ACCURATE, RELIABLE, ERROR-FREE, OR UNINTERRUPTED, THAT DEFECTS WILL BE CORRECTED, THAT OUR SITE OR THE SERVER THAT MAKES IT AVAILABLE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS, OR THAT THE SITE OR ANY SERVICES OR ITEMS OBTAINED THROUGH THE SITE WILL OTHERWISE MEET YOUR NEEDS OR EXPECTATIONS.

TO THE FULLEST EXTENT PROVIDED BY LAW, THE COMPANY HEREBY DISCLAIMS ALL WARRANTIES OF ANY KIND, WHETHER EXPRESS OR IMPLIED, STATUTORY, OR OTHERWISE, INCLUDING BUT NOT LIMITED TO ANY WARRANTIES OF MERCHANTABILITY, NON-INFRINGEMENT, AND FITNESS FOR PARTICULAR PURPOSE.

THE FOREGOING DOES NOT AFFECT ANY WARRANTIES THAT CANNOT BE EXCLUDED OR LIMITED UNDER APPLICABLE LAW.

You must not misuse the Site by knowingly introducing material that is malicious or technologically harmful, including viruses, malware, trojans, worms or logic bombs. You must not attempt to gain unauthorized access to, interfere with, damage, or disrupt any parts of the Site, the server on which the Site is stored or any server, computer or database connected to the Site. You must not attack the Site via a denial-of-service attack or a distributed denial-of-service attack.

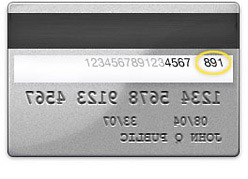

If you choose, or are provided with, a user name, password, or any other piece of information as part of our security procedures, you must treat such information as confidential, and you must not disclose it to any other person or entity. You also acknowledge that your account is personal to you and agree not to provide any other person with access to this Site or portions of it using your user name, password, or other security information. You agree to notify us immediately of any unauthorized access to or use of your user name or password or any other breach of security. You also agree to ensure that you exit from your account at the end of each session. You should use particular caution when accessing your account from a public or shared computer so that others are not able to view or record your password or other personal information.

Use of Information Submitted

You agree that Skechers is free to use any comments, information or ideas contained in any communication you may send to the Site or submit to the Site without notice, compensation or acknowledgement to you for any purpose whatsoever, including, but not limited to, developing, manufacturing and marketing products and services and creating, modifying or improving the Site or other products or services. To the degree necessary, you grant Skechers a license to use that content.

To access or use the Site, you may be asked to provide certain registration details or other information. It is a condition of your use of the Site that all the information you provide on the Site is correct, current, and complete.

Participation Disclaimer / Use Restrictions

Skechers does not and cannot review all communications and materials posted to or created by users accessing the Site and is not in any manner responsible for the content of these communications and materials. You acknowledge that by providing you with the ability to view and distribute User Generated Content on the Site, the Site is merely acting as a passive conduit for such distribution and is not undertaking any obligation or liability relating to any User Generated Content or activities on the Site. The views expressed by others on our site do not represent our views or values. Skechers has the right but not the obligation to remove communications and materials posted to the Site by users.

You may not post or otherwise distribute content to the Site which Skechers, in its sole discretion, determines to be abusive, harassing, threatening, defamatory, obscene, an impersonation of others, fraudulent, deceptive, misleading, in violation of a copyright, trademark or other intellectual property right of another, invasive of privacy or publicity rights, in violation of any other right of Skechers or another party, illegal, or otherwise objectionable to Skechers. You may not upload commercial content on the Site or use the Site to solicit others to join or become members of any other commercial online service or other organization. You warrant that any post or distribution that you make on the Site complies with the above standards, and you will be liable to Skechers for any losses that result from your violation of these standards. If legal, Skechers may disclose your identity to a third party who is claiming that any content posted or uploaded by you to the Site constitutes a violation of their intellectual property rights, is a breach of confidential information or is defamatory.

Indemnification

You agree to indemnify, defend, and hold harmless Skechers, its officers, directors, employees, agents, licensors and suppliers from and against all losses, expenses, damages and costs, including reasonable attorneys’ fees, resulting from any violation of these terms and conditions or any activity related to your Internet account (including negligent or wrongful conduct) by you or any other person accessing the Site using your Internet account.

Skechers has the right to cooperate fully with any law enforcement authorities or court order requesting or directing us to disclose the identity or other information of anyone posting any materials on or through the Site. YOU WAIVE AND HOLD HARMLESS SKECHERS AND ITS AFFILIATES, LICENSEES, AND SERVICE PROVIDERS FROM ANY CLAIMS RESULTING FROM ANY ACTION TAKEN BY SUCH PARTIES DURING, OR TAKEN AS A CONSEQUENCE OF, INVESTIGATIONS BY EITHER SUCH PARTIES OR LAW ENFORCEMENT AUTHORITIES.

Limitation of Liability

TO THE FULLEST EXTENT PROVIDED BY LAW, IN NO EVENT WILL SKERCHERS, ITS AFFILIATES, OR THEIR LICENSORS, SERVICE PROVIDERS, EMPLOYEES, AGENTS, OFFICERS, OR DIRECTORS BE LIABLE FOR DAMAGES OF ANY KIND, UNDER ANY LEGAL THEORY, ARISING OUT OF OR IN CONNECTION WITH YOUR USE, OR INABILITY TO USE, THE SITE, ANY WEBSITES LINKED TO IT, ANY CONTENT ON THE SITE OR SUCH OTHER WEBSITES, INCLUDING ANY DIRECT, INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL, OR PUNITIVE DAMAGES, INCLUDING BUT NOT LIMITED TO, PERSONAL INJURY, PAIN AND SUFFERING, EMOTIONAL DISTRESS, LOSS OF REVENUE, LOSS OF PROFITS, LOSS OF BUSINESS OR ANTICIPATED SAVINGS, LOSS OF USE, LOSS OF GOODWILL, LOSS OF DATA, AND WHETHER CAUSED BY TORT (INCLUDING NEGLIGENCE), BREACH OF CONTRACT, OR OTHERWISE, EVEN IF FORESEEABLE.

THE FOREGOING DOES NOT AFFECT ANY LIABILITY THAT CANNOT BE EXCLUDED OR LIMITED UNDER APPLICABLE LAW.

Termination and Effect of Termination

These Terms are applicable to you upon your accessing the Site. Skechers reserves the right in its sole discretion to terminate or restrict your use of the Site, without notice, for any or no reason, and without liability to you or any third party. In addition, these Terms, or any part of them, may be terminated or modified by Skechers without notice at any time, for any reason. All changes are effective immediately when we post them. Your continued use of the Site following the posting of revisions to the Terms means that you accept and agree to the changes. You are expected to check this page from time to time so you are aware of any changes, as they are binding on you. The provisions relating to Copyright, Trademarks, Disclaimer, Limitation of Liability, Indemnification and Miscellaneous, shall survive any termination.

Waiver and Severability

No waiver by Skechers of any term or condition set out in these Terms shall be deemed a further or continuing waiver of such term or condition or a waiver of any other term or condition, and any failure of Skechers to assert a right or provision under these Terms shall not constitute a waiver of such right or provision.

If any provision of these Terms is held by a court or other tribunal of competent jurisdiction to be invalid, illegal, or unenforceable for any reason, such provision shall be eliminated or limited to the minimum extent such that the remaining provisions of the Terms will continue in full force and effect.

Governing law and Jurisdiction

These Terms are governed by English law and you can bring legal proceedings in respect of them in the English courts.

Alternative dispute resolution is a process where an independent body considers the facts of a dispute and seeks to resolve it, without you having to go to court. The European Online Dispute Resolution (ODR) Platform is accessible here. We are not obliged to use alternative dispute resolution and do not currently submit to it.